It’s no secret that carving out a high-flying career in finance hinges on more than just good grades.

In today’s fast-evolving workplace, accounting and finance professionals must demonstrate everything from razor-sharp analytical ability and stellar interpersonal skills, to a sharp understanding of industry-standard finance software and regulations.

Related: Need help improving your resume? Download our free professional resume template here.

So, how do you know whether your resume will reach the top of the pile or is destined to fall short?

Whether you're a fresh graduate entering the workforce, a seasoned professional making a career change, or someone seeking career advancement, understanding and applying financial skills is a game-changer to securing the finance role.

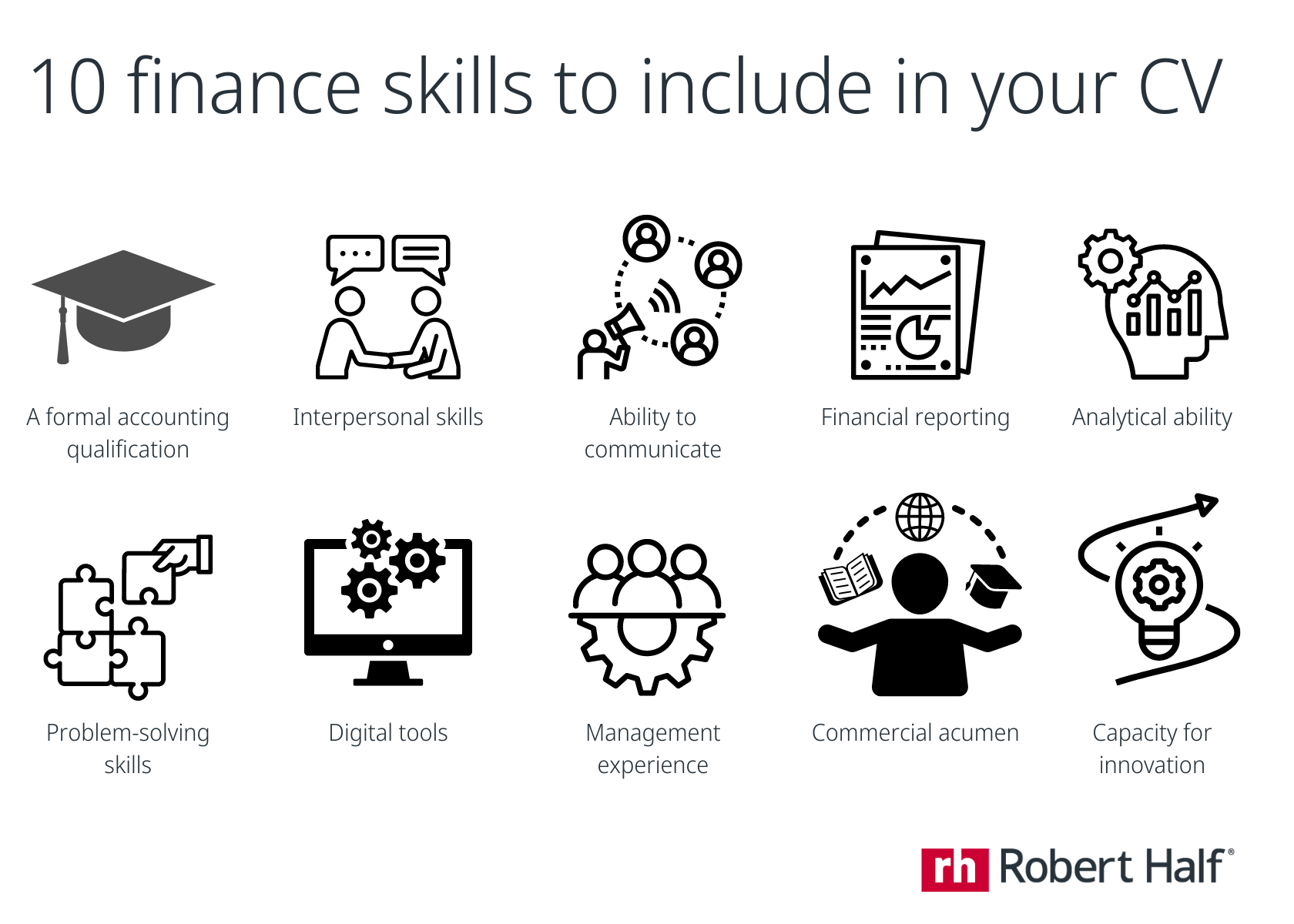

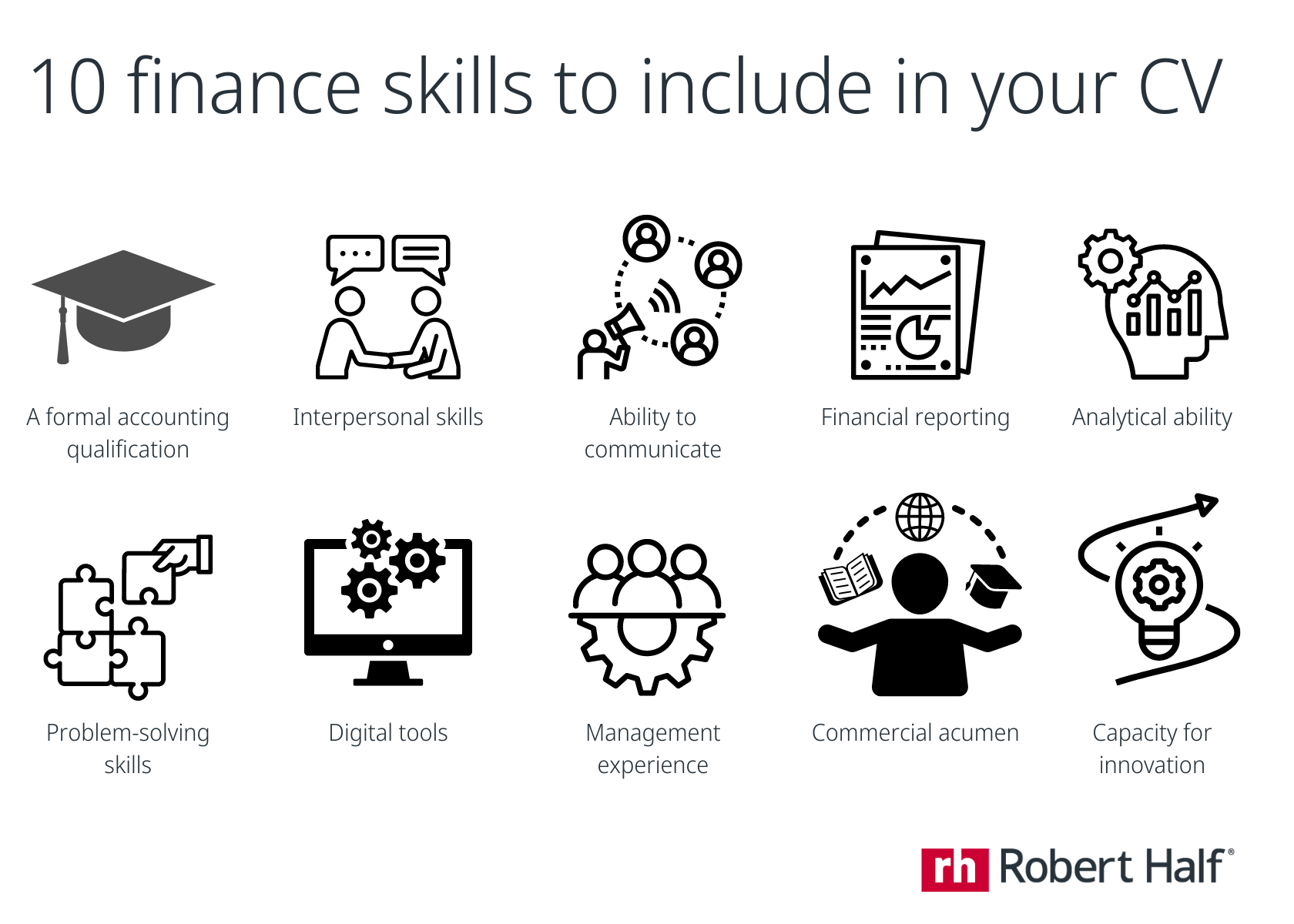

Here are the top 10 financial skills that will put you in prime position for a promising career in finance.

1. A formal accounting qualification

In some industries, sparkling talent combined with real-world experience is enough to land your dream job.

But a career in finance – a sector ruled by rigorous processes and standards as well as commercial best practices – a glowing CV simply isn’t enough.

Successful candidates will have completed recognised industry qualifications to demonstrate they have the necessary educational training to back-up any work experience they have. Highlighting qualifications such as a CA or CPA are important.

If you do not have a formal accounting qualification, it may be worth looking into one. The Robert Half Salary Guide lists the following most in-demand certifications and degrees for finance and accounting professionals:

Australian Professional accounting qualifications (CA / CPA)

Overseas professional accounting qualifications (ACCA / CIMA)

Relevant bachelor’s degree in finance / economics / commerce

CTA / CFA

MBA

By having at least one of these under your belt, it gives you a competitive advantage against other candidates and positions you as a sought-after candidate.

2. Interpersonal skills

There once was a time when finance professionals were bound to cubicles, but that era is long gone.

These days, any perception that finance skills involves simply crunching numbers has been replaced by the reality that positions require workers to deal with clients every day.

For accounting and finance professionals, the ability to build successful relationships with customers is critical if you want to excel. When looking at two equally qualified hires, interpersonal skills are often the point of difference.

To gain this skill to include on your resume, practice active listening by paying attention to others, asking clarifying questions, and reflecting back what you hear. Engage in meaningful conversations, both in and out of work, to develop your communication skills and build rapport with others.

3. Ability to communicate

For aspiring accounting and finance workers, strong written and oral communication skills are important, but it’s just as imperative to be able to explain financial jargon in simple terms.

Many companies choose candidates who can make complex industry language legible to clients who have limited knowledge, as opposed to potential hires who simply regurgitate what they’ve learned.

Related: What kind of jobs are in-demand in finance?

4. Financial reporting

There’s no denying that financial reporting skills is a requisite requirement, particular with in growing areas, such as superforecasting.

However, finding candidates with strong financial reporting skills is proving a challenge in this sector.

In a survey conducted by Robert Half in 2023 among 100 CFOs found 25% of CFOs need financial reporting skills but are currently missing them in their operative workforce, 24% say they are missing it in their leadership and 19% say they are missing it in both!

Financial candidates looking for a competitive edge would be wise to ensure they can demonstrate a high aptitude for financial reporting at their next job interview.

5. Analytical ability

Brody Johnston, Division Director at Robert Half and specialised finance and accounting recruiter says having an analytical ability and demonstrating it on your resume is key to helping you shine against other candidates.

He says, "Today's finance world is heavily data-driven. A resume that showcases your ability to gather, interpret, and leverage data to make informed decisions demonstrates your value and potential impact on any organisation. This is extremely important as hiring managers are focused on ‘value-add’ when considering which roles to hire for, and who to place in those roles.”

Companies are looking to hire employees who can implement lateral thinking, the ability to analyse scenarios, and draw suitable conclusions.

Candidates looking for a successful career in finance must demonstrate their analysis abilities with real-world examples and KPI driven results.

6. Problem-solving skills

These days, it isn’t enough to have watertight knowledge of systems and processes – it’s also essential to be able to tackle complex problems as they arise.

Whether it’s addressing the financial implications of a complicated business structure or coming up with a personalised solution for a client’s tax dilemma, a record of solving problems will see your career grow in leaps and bounds.

7. Knowledge of digital tools

The increased focus on digitisation and automation has encouraged more hiring managers to look toward financial professionals with the right IT skills to leverage new financial systems.

The same Robert Half survey found 23% CFOs lack digital literacy in their operative workforce, 26% are missing it in their leadership and 24% are missing it in both.

Candidates who can demonstrate knowledge and proficiency in predictive analytics, accounts payable automation, SAP accounting software or Oracle will find themselves in-demand.

Be sure to name the financial software you have experience in like Xero, QuickBooks or industry-standard financial modelling tools like Excel. It is more powerful to specify the programs as it could be a strong advantage to other businesses who use the same programs. That’s not to say you couldn’t get hired at a company that uses different software, it means that they are aware you have used one in the past and have a track record to pick up new digital skills required.

8. Management experience

Although it’s not essential, management experience is often highly desirable for employers looking to hire a financial professional for a new role.

If you’ve proven your ability to manage teams during your career, you’re bound to excel in a leadership position in the future.

Joel Herbert, another Division Director at Robert Half and specialised finance and accounting recruiter says including management experience in a resume can send a powerful signal to employers.

Drawing on his almost seven years of experience recruiting finance and accounting talent, he says, “The idea of a resume is to showcase your key financial skills and milestones in your career to date. If you have management experience, be sure to highlight this in your resume. Even if you are not going for a management role, this skill demonstrates leadership, decision-making, and the ability to drive results through others - qualities highly valued by a company and team of any size. It's like a stamp of approval, saying you've been tested and proven in a challenging role."

9. Commercial acumen

Commercial acumen is in the spotlight now more than ever given the rapidly changing and volatile economic landscape in Australia and around the world.

It’s important for financial professionals to understand the relationship between a company’s fiscal behaviour and marketplace demands.

Candidates that can exercise commercial acumen as well as an interest in the trends shaping the industry are well-placed to get ahead.

Related: What jobs in finance pay the most?

10. Capacity for innovation

Finance and accounting may be associated with routines and systems, but that doesn’t mean that innovation doesn’t have its place.

Whether you’ve invented a data-collection method that streamlines productivity or a recording process that drives accuracy, candidates who are innovative are likely to stand out.

Brody adds, “A recent example would be a finance professional open to using artificial intelligence or thinking outside the box to transform the way they work. Innovation and change management go hand in glove when it comes to adapting to the future of finance, so if you have that, put it loud and clear on your CV!”

Have specialised skills?

It goes without saying that some finance roles may call for more specialised skills, depending on the type of business you intend to join.

For example, FinTech demands a blend of financial acumen and technological prowess, requiring professionals to navigate digital platforms, blockchain, and data analytics. Meanwhile, Sustainable Finance calls for a deep understanding of environmental, social, and governance (ESG) factors, carbon markets, and impact investing.

To thrive in these sectors, professionals must continuously adapt and upskill, mastering the unique skill sets that each domain demands. This continuous learning not only enhances individual career prospects but also fuels innovation and growth within these transformative fields.

It is essential to tailor your resume to suit your application. Critically analyse the type of business you intend to join, and highlight how your experience marries with their world. This will help strengthen your profile as a desired candidate.

Have you included these fiancial skills in your CV?

From brushing up on your financial reporting skills to cultivating the ability to think outside the box, broadening your skill set is paramount to establishing a career in finance that lasts.

Proficiency in in-demand financial skills like those mentioned in this blog can significantly increase your earning potential as companies compete for top talent. Indeed, if you can tick most of these boxes, you just might be one of finance’s most sought-after professionals with a promising career ahead of you.

Ready to kickstart your career in finance? Or are you already on the hunt for your next career opportunity in finance? Contact us today and one of our specialised finance recruitment consultants will work with you to find the right role for your career.

Frequently Asked Questions (FAQs)

What financial software should I learn for a career in finance?

Microsoft Excel is used for data manipulation, financial modelling, and creating reports. Advanced knowledge of functions like VLOOKUP, pivot tables, and macros is highly valued.

Tools like Argus Enterprise, and CoStar are used for real estate financial modelling, while FactSet and Capital IQ are used in investment banking and equity research.

Tableau, Power BI, and QlikView help in presenting complex financial data in an easy-to-understand visual format.

Python, R, and SQL are becoming increasingly important for data analysis, automation, and building financial models.

QuickBooks, Xero, and Sage are essential for roles in accounting and bookkeeping.

What are the most in-demand financial certifications?

The Robert Half Salary Guide lists the following most in-demand certifications and degrees for finance and accounting professionals:

Australian Professional accounting qualifications (CA / CPA)

Overseas professional accounting qualifications (ACCA / CIMA)

Relevant bachelor’s degree in finance / economics / commerce

CTA / CFA

How can I improve my communication skills to explain financial concepts clearly?

Simplify complex jargon into relatable terms

Use visual aids like charts or graphs to illustrate your points

Practice active listening

Tailor your communication style to your audience's level of financial literacy

What are the best ways to showcase problem-solving skills in a finance interview?

Highlight specific examples from your past experience where you successfully tackled complex financial challenges, outlining the steps you took, the outcome you achieved, and the impact it had on the organisation.

Use the STAR method (Situation, Task, Action, Result) to structure your responses, providing quantifiable results whenever possible to demonstrate your problem-solving prowess.

What are the top skills needed for a career in FinTech?

Building and analysing financial models to evaluate investment opportunities and assess risk.

Knowledge of various financial instruments, asset classes, and market dynamics.

Familiarity with financial regulations and compliance requirements is essential for operating in the FinTech space.

Are there any free resources to improve my financial skills?

Financial Basics Foundation

Coursera, edX, and Udemy

How can I tailor my resume to highlight my financial skills?

Quantify achievements

Use relevant keywords

Highlight specific software proficiency

Showcase certifications

Skills-focused section

Tailor resume to the job